Table of Contents

Scripps Safe Inc. Prepares for Takeoff

Scripps Safe, Inc., a company dedicated to securing medications in the legal supply chain, is about to take off with its impending Initial Public Offering. This highly anticipated event has sparked substantial interest among investors, particularly those looking for exposure to the booming healthcare security market.

IPO Details and Allotment:

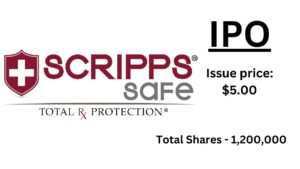

- Estimated IPO Date: February 13, 2024 (Subject to market conditions)

- Estimated Price Range: $4.00 – $6.00 per share

- Number of Shares Offered: 1.2 million (subject to change)

- Estimated Deal Size: $4.8 million – $7.2 million (subject to final pricing)

- Lead Bookrunner: Spartan Capital Securities

Company Overview:

Scripps Safe provides a unique value offering in the healthcare security industry. The Scripps System™ is a PaaS system that secures medications across the supply chain. This comprehensive solution comprises secure storage (vaults and safes), access control management, and real-time tracking capabilities, which ensure regulatory compliance while reducing the danger of diversion or theft.

Market Potential:

The pharmaceutical security industry is predicted to expand significantly in the future years, driven by factors such as rising opioid misuse, stronger regulations, and increased demand for safe drug storage.

Scripps Safe is well-positioned to capitalise on this trend with to its innovative technology and focus on important verticals such as mobile medicine delivery, private ambulance operations, and addiction treatment centres.

Key Investment Considerations:

As with any IPO, there are inherent risks involved. Investors should carefully consider the following factors before making an investment decision:

- Early-stage company: Scripps Safe is still in its early stages of development, with limited revenue and a history of operating losses.

- Competitive landscape: The healthcare security market is competitive, with established players and emerging startups vying for market share.

- Regulatory environment: The regulatory landscape surrounding pharmaceutical security is complex and subject to change, which could impact the company’s operations.

Conclusion:

The Scripps Safe IPO is an attractive opportunity for investors looking to gain exposure to the booming healthcare security business. The company’s innovative technology, emphasis on important verticals, and experienced management team are all promising signs.

However, before making an investment decision, extensive due diligence and an understanding of the related risks are required.