NeoPolitan Pizza and Foods Limited, a well-known company in the Indian food business, is preparing to make its stock market debut through an Initial Public Offering (IPO).

This highly anticipated event has aroused the curiosity of both experienced and new investors eager to capitalise on the future expansion of this vibrant company.

Table of Contents

NeoPolitan Pizza and Foods Limited IPO

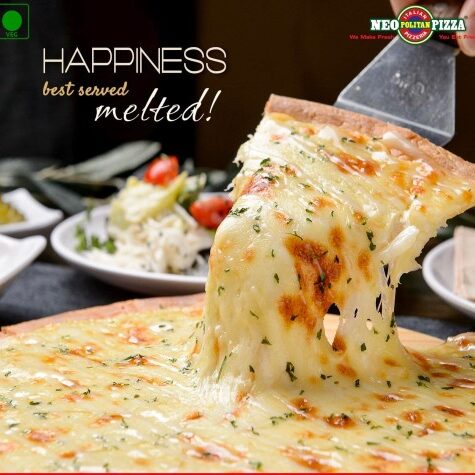

NeoPolitan Pizza and Foods Limited has carved out a niche for itself by serving a delightful selection of pizzas, pasta, and other Italian delicacies.

With a strong emphasis on quality, taste, and customer happiness, the brand has amassed a loyal following across the country. Its wide network of shops, combined with its online ordering platform, has made it a convenient and accessible option for food lovers.

Key Details of the IPO

- Issue Type: Fresh Issue

- Issue Size: ₹12 crores

- Price Band: ₹20 per share

- Listing Exchange: BSE SME

- Open Date: September 30, 2024

- Close Date: October 4, 2024

- Allotment Date: October 7, 2024

- Listing Date: October 9, 2024

Reasons to Consider Investing in the IPO

- Growing QSR Market: The QSR industry in India has been witnessing steady growth, driven by factors such as rising disposable incomes, changing lifestyles, and increasing urbanization.

- Strong Brand Recognition: The company’s “NeoPolitan Pizza” brand has gained popularity in its operating regions, which could translate into a loyal customer base.

- Expansion Plans: The IPO proceeds may be used to expand the company’s network of restaurants, both in existing and new markets.

Risks and Considerations

- Competition: The QSR industry is highly competitive, with established players and new entrants vying for market share.

- Raw Material Costs: Fluctuations in the prices of raw materials, such as flour, cheese, and vegetables, can impact the company’s profitability.

- Regulatory Changes: Changes in government regulations related to food safety, taxation, or labor laws could pose challenges to the company’s operations.

Investment Considerations

- Competition: The food industry is extremely competitive, with many companies striving for market share. To continue growing, NeoPolitan Pizza and Foods Limited must maintain a competitive advantage.

- Regulatory Changes: Changes in government policies or regulations governing food safety, taxation, or labor laws may have an impact on the company’s operations and profits.

- Economic Factors: Economic downturns or variations in consumer spending can have an impact on demand for food goods, particularly those sold by NeoPolitan Pizza and Foods Limited.

Conclusion

The IPO of NeoPolitan Pizza and Foods Limited is an excellent investment opportunity for individuals wishing to contribute to the growth of the Indian food industry.

While the company’s strong brand value and development possibilities make it an appealing proposition, investors should analyze the risks and factors that could affect its performance.

NOTE: Please keep in mind that this post is only designed to provide information and is not financial advice. It is always advisable to contact with a financial counselor before making any investing decisions.

2 thoughts on “NeoPolitan Pizza and Foods Limited IPO: A Sizzling Investment Opportunity?”