Hyundai Motor India Limited IPO is a division of the massive South Korean automaker Hyundai Motor Company, Hyundai Motor India Limited (HMIL) is preparing for the much awaited Initial Public Offering (IPO) in India. Although the IPO’s precise date and price range have not yet been made public, market speculation indicates that it may rank among the biggest in the nation’s history.

Table of Contents

Hyundai Motor India Limited IPO

Due to its constant delivery of well-liked and dependable automobiles, HMIL has established itself as a major force in the Indian car industry. To meet the needs of different consumer segments, the company offers a wide variety of automobiles, SUVs, and commercial vehicles in its product inventory. The following are some of the reasons for HMIL’s success:

- High Brand Recognition: Hyundai enjoys a trusted position among Indian consumers thanks to its international reputation for quality and innovation, which has translated effectively into the Indian market.

- Broad Distribution Network: Customers may be easily reached and receive after-sales service thanks to the company’s extensive dealership network throughout India.

- Innovative Product Offerings: In order to stay up to date with changing consumer tastes and industry trends, HMIL has continuously released new models and technologies.

- Robust Manufacturing Capabilities: The company’s modern, technology-equipped manufacturing facilities in India allow for cost-effective operations and productive output.

Key Details of the IPO

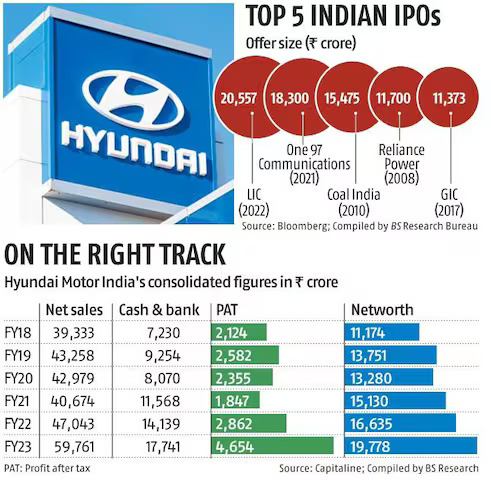

- IPO Size: 27870.16 Cr

- Issue Price (Rs): 1865.00 to 1960.00

- Open Date: Oct 15, 2024

- Close Date: Oct 17, 2024

- Listing Date: Oct 22, 2024

- Exchange: BSE, NSE

Potential Benefits of Investing in HMIL IPO

Investing in the HMIL IPO could offer several potential benefits to investors:

Growth Potential: Investors may expect sizable returns on their investment given the company’s excellent market position and growth possibilities.

Dividend Payouts: As an established and successful business, HMIL may think about giving its investors dividend payments to provide a reliable source of revenue.

Brand Value: Adding Hyundai to an investor’s portfolio helps improve portfolio diversification. Hyundai is a reputable and well-established brand.

Exposure to the Indian Automotive Market: The IPO offers a chance to learn more about the quickly expanding Indian automotive sector, which is being fueled by shifting customer tastes and rising earnings.

Key Considerations for Investors

While the HMIL IPO appears promising, potential investors should carefully consider the following factors:

- Evaluation: Whether or not the investment is appropriately valued will be largely dependent on the IPO’s pricing. Investors ought to assess the company’s growth potential and financial performance against the IPO valuation.

- Market Competition: Companies fighting for market share in India’s automobile industry include Maruti Suzuki, Tata Motors, and Mahindra & Mahindra. Sustainability of HMIL’s competitive advantage will be critical to its long-term success.

- Regulatory Environment: Modifications to laws or policies may have an effect on the automobile industry’s expansion and profitability. Potential risks related to regulations should be known to investors.

- Economic Situation: The demand for cars among consumers in India would be influenced by the country’s general economic situation. A recession can have a detrimental effect on HMIL’s earnings and sales.

Conclusion

In the Indian financial market, the HMIL IPO is probably going to be highly awaited. The company is well-positioned for growth in the future thanks to its unique product offerings, wide distribution network, and strong brand. Before making an investment, however, prospective investors should do a lot of research and take the previously mentioned criteria into account. Investors can make well-informed decisions depending on their investment goals and risk tolerance as the IPO date and pricing information are revealed.

Note: Nothing in this post should be interpreted as financial advice; it is merely informational. Before deciding what to invest in, investors should do their own research.