Table of Contents

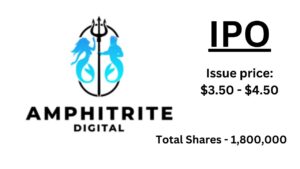

Amphitrite Digital IPO:

Amphitrite Digital Inc., a maritime tour operator that specialises in up-close interactions with marine life, ecology, and history, is planning to launch an initial public offering (IPO).

The firm, headquartered in the United States Virgin Islands, has filed its registration statement with the SEC and is scheduled to begin trading on the NYSE American under the ticker code “AMDI” on February 14, 2024.

Riding the Wave of Tourism Recovery:

Amphitrite Digital’s IPO coincides with a rebounding tourism economy. Following the pandemic-induced recession, travel spending is predicted to return to pre-pandemic levels by 2024, owing to pent-up demand and rising disposable income.

This bodes well for Amphitrite, which caters to a certain market looking for unique and immersive experiences.

Key Details of the IPO:

- Offering size: 1.75 million shares (reduced from 1.9 million)

- Price range: $3.50 to $4.50 per share (down from $4.25 to $6.25)

- Estimated raise: $7 million (down from $9.98 million)

- Lead bookrunner: Kingswood Capital Markets (replacing Maxim Group LLC)

What Makes Amphitrite Different?

Amphitrite sets itself apart from regular cruise companies and tour operators by offering:

- Small-group, personalised experiences: With a maximum capacity of 40 passengers per vessel, Amphitrite guarantees intimate interactions with marine life and cultural sites.

- Focus on sustainability: The company prioritises environmentally friendly operations and strives to reduce its environmental impact.

- Amphitrite has a diverse portfolio, offering tours ranging from snorkelling excursions to historical expeditions throughout the US Virgin Islands, Florida, and Illinois.

Risks and Challenges:

Despite the optimistic outlook, Amphitrite confronts several challenges:

- Competition: The maritime tourist business is fiercely competitive, with both established players and new entrants striving for market share.

- Profitability: Amphitrite is not yet profitable, which raises questions about its long-term viability.

- Seasonality: The company’s revenue is highly based on peak tourist seasons, making it vulnerable to economic downturns.

Should You Invest?

The decision to invest in Amphitrite’s IPO is based on your own risk tolerance and investment objectives. The company has the potential to capitalise on the growing desire for unique travel experiences, but its lack of profitability and competitive landscape are concerning.

Investors should carefully evaluate these concerns and perform extensive due research before making any investing decisions.